Premier Improvements Solar is approved as a solar contractor with Connecticut Green Bank for Smart-E Loans. This means that our customers can now access low-interest financing for their solar panel installations in CT.

Going solar has never been more affordable and convenient!

Contact us today to learn more about this great opportunity.

A Smart E Solar Loan with CT GreenBank allows you to borrow the exact amount of money you need, with the option to adjust your payments based on your financial situation. This can make it easier to manage your finances and avoid taking on more debt than you can handle.

Applying for a Smart E Solar Loan with CT GreenBank is quick and easy, with a simple online application process and fast turnaround times. This means you can get the money you need quickly and without any hassle.

CT Greenbank offers competitive interest rates on its Smart E Solar Loans in Connecticut, which can save you money in the long run. Additionally, the bank’s commitment to sustainability and renewable energy means that you can feel good about supporting a company that is working to make a positive impact on the world.

The CT Green Bank Smart-E Solar Loans program is a financing option for residents of Connecticut looking to install solar panels on their homes.

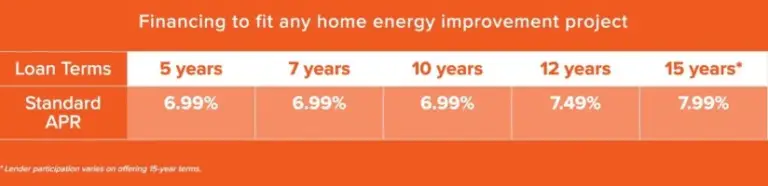

This loan program offers competitive interest rates and flexible repayment terms to make the switch to renewable energy more accessible and affordable.

With the CT GreenBank Smart E Solar Loans program, homeowners can take advantage of the benefits of solar energy without having to pay upfront costs.

The program is designed to help homeowners save money on their energy bills and reduce their carbon footprint.

Solar installation services in Connecticut can help homeowners apply for the CT Green Bank Smart E Solar Loans program and guide them through the process of installing solar panels on their homes.

These solar installation services can help homeowners understand the benefits and potential cost savings of switching to solar energy, as well as help them navigate the loan application and installation process.

By choosing a reputable and experienced solar installation service, homeowners can be confident that they are making a smart investment in the future of their home and the environment.

A CT GreenBank Smart-E Loan can be used for over 40 home energy improvements, from insulation and energy-efficient windows to heat pumps and solar panels.

You can also use up to 25% of your loan for non-energy related measures and healthy home improvements, such as new ENERGY STAR appliances, lead removal, or roof repairs in advance of going solar.

(The current maximum loan amount for Smart-E Loan is $50,000 with up to $75,000 on approved credit.)

Q: I’m interested in a loan from CT Green Bank. Does it matter whether I live in Westport, Fairfield County, or another town?

A: The CT Green Bank can potentially provide loans to all CT Residents.

Q: How do I apply for a CT Green Bank Smart E-Loan?

A: You can apply for a loan through the CT Green Bank website, or email ctgreenbank@centralct.gov.

Q: How do I apply for a CT Green Bank loan?

A: Visit www.ctgreenbank.com and click on “Apply Now”. If you want help finding the right loan for your needs, they can also be reached at 860-713-7900 or by emailing ctgreenbank@centralct.gov.

Q: What is the difference between a Smart Loan and a traditional CT GreenBank Loan?

A: A Smart E Loan is a loan that utilizes technology to give you more control over your loan experience, including automatic payments, pay-as-you-go for loans under $5,000, and payments via your debit card or direct deposit.

Q: Is there an annual fee associated with having a CT GreenBank Smart E-Loan?

A: There are no annual fees associated with this product.

Q: What is the CT GreenBank Smart-E Loan?

A: The CT GreenBank Smart-E Loan is a financing program offered by the Connecticut Green Bank. It’s specifically designed to help homeowners in Connecticut finance energy-efficient home improvements, including solar panel installations. This loan program aims to make sustainable home upgrades more accessible and affordable.

Q: How does the Smart-E Loan benefit those going solar?

A: The primary benefit of the Smart-E Loan for solar projects is its favorable financing terms. It offers low-interest rates, which can significantly reduce the overall cost of solar installations. This makes solar energy a more financially viable option for many homeowners, enhancing the affordability of transitioning to renewable energy.

Q: Are there specific eligibility requirements for the Smart-E Loan?

A: Yes, there are certain eligibility criteria for the Smart-E Loan. Applicants usually need to have a satisfactory credit score and their property must be located in Connecticut. Other requirements may include the home’s energy efficiency level and the specifics of the proposed improvements.

Q: What types of solar installations are covered under the Smart-E Loan?

A: The Smart-E Loan typically covers a range of solar installations. This includes new roof plus solar panel packages, ground-mounted solar installations, and even solar battery storage systems. It’s crucial to confirm with the CT GreenBank or your solar provider about the specific eligibility of various solar solutions under this loan.

Q: How does the loan application process work?

A: The application process for the Smart-E Loan involves several steps. Homeowners need to apply through an approved lender. The process includes a credit check, property assessment, and detailed discussion of the proposed energy-efficient improvements. Solar providers often assist in this process, providing necessary documentation and guidance.

Q: Can the Smart-E Loan be combined with other incentives or rebates?

A: Yes, the Smart-E Loan can typically be combined with other incentives such as federal tax credits, state-specific solar incentives, or utility rebates. This combination can further reduce the cost of solar installations, making them more budget-friendly.

Q: What are the repayment terms of the Smart-E Loan?

A: The Smart-E Loan’s repayment terms typically include competitive interest rates and various term lengths to fit different financial situations. The specific terms can vary, so it’s essential to discuss this with the lender to understand the monthly repayment amounts and the total duration of the loan.

Q: How does the Smart-E Loan impact the overall cost of a solar installation?

A: By offering low-interest financing, the Smart-E Loan can significantly lower the upfront cost of solar installations. Over time, the savings on energy bills can offset the loan repayments, leading to an overall positive financial impact and a solid return on investment.

Q: Is there support available throughout the loan period?

A: During the loan period, borrowers usually have access to support from their lender and solar provider. This includes assistance with any queries or issues related to the solar installation or the loan itself.

Q: What happens if I sell my home?

A: If you sell your home, the responsibility for the Smart-E Loan depends on the loan terms. In some cases, the loan may need to be paid off upon the sale of the property. Alternatively, there may be options to transfer the loan to the new homeowner, subject to the lender’s approval and the new homeowner’s eligibility.

At Premier Improvements Solar, we use the latest in solar technology to ensure optimal performance and longevity for your solar system. Our experienced technicians handle every aspect of the installation process with precision and care, from initial site assessment to final system activation. We also offer comprehensive maintenance and support to keep your solar system running smoothly for years to come.

Choosing Premier Improvements Solar means partnering with a company committed to excellence, innovation, and customer satisfaction. Our dedication to quality and our extensive experience in the solar industry have earned us a reputation as a trusted solar provider in Connecticut. Let us help you make the switch to clean, renewable energy and start enjoying the benefits of lower energy bills and a reduced carbon footprint.

Experience the difference with Premier Improvements Solar and join the growing number of Connecticut homeowners who have selected us for their solar needs. Contact us today to schedule a consultation and take the first step toward a more sustainable future.

Veteran‑owned Connecticut solar installer. 25‑year full warranties. 5‑star customer service

Get CT solar tips, incentives updates & exclusive offers

Licensed & Insured in Connecticut • CT Lic. #HIC.0556789